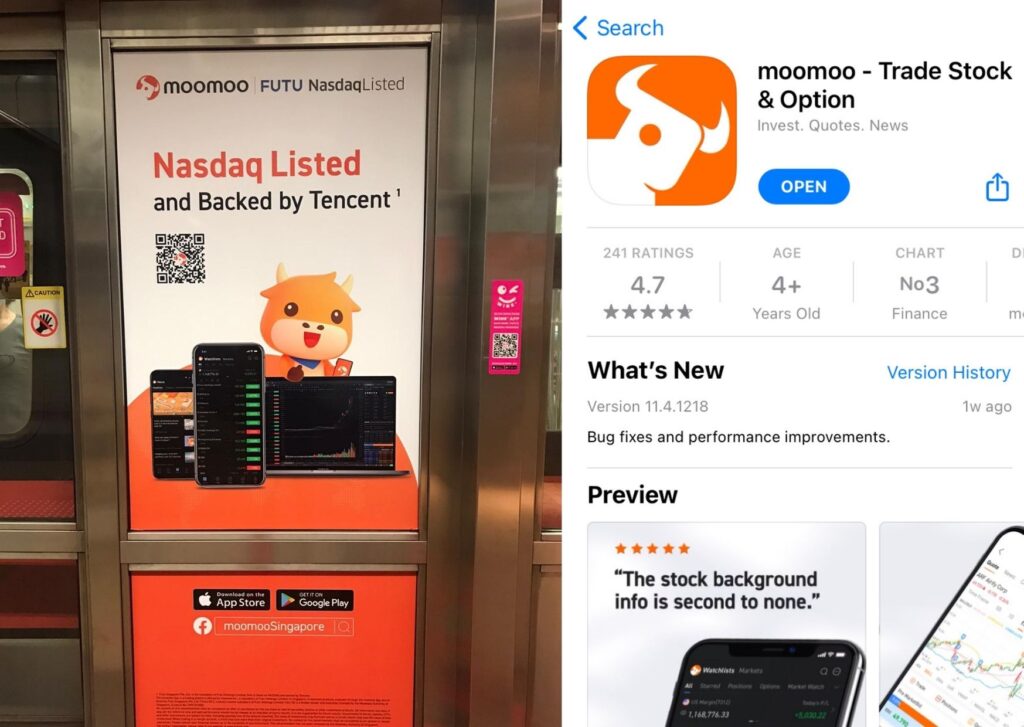

I see Moomoo everywhere – on bus advertisements and sponsored reviews by financial bloggers in Singapore. I first came across it on Seedly Facebook. It happened that I was looking for a suitable trading platform to trade US stocks and Moomoo came along. With an Appstore rating of 4.7 stars out of 5, it’s definitely worth looking into. So I thought, why not? But is it even a safe and secured trading platform?

Is it a reliable trading platform?

You probably have the same doubts as I do. ‘Moomoo’ didn’t sound very professional. I hope it’s not another shady company. It claims to be commission-free and they even give out 1 Apple share for free when you sign up with them. Is that too good to be true?

Yes, it’s really that good as I soon find out after doing my research and reading articles on Moomoo. This new trading brokerage platform is a subsidiary by , a Hong Kong-based online brokerage that is backed by Tencent. I was more assured after discovering Futu Holdings Limited as an office in Singapore and it is licensed by Monetary Authority of Singapore (MAS). Moreover, the brokerage accounts you own with Futu Inc. are protected by the Securities Investor Protection Corporation (SIPC). The SIPC provides some protection over an investor’s securities and cash when a brokerage firm is liquidated.

I tried Moomoo so that you don’t have to (be that guinea pig).

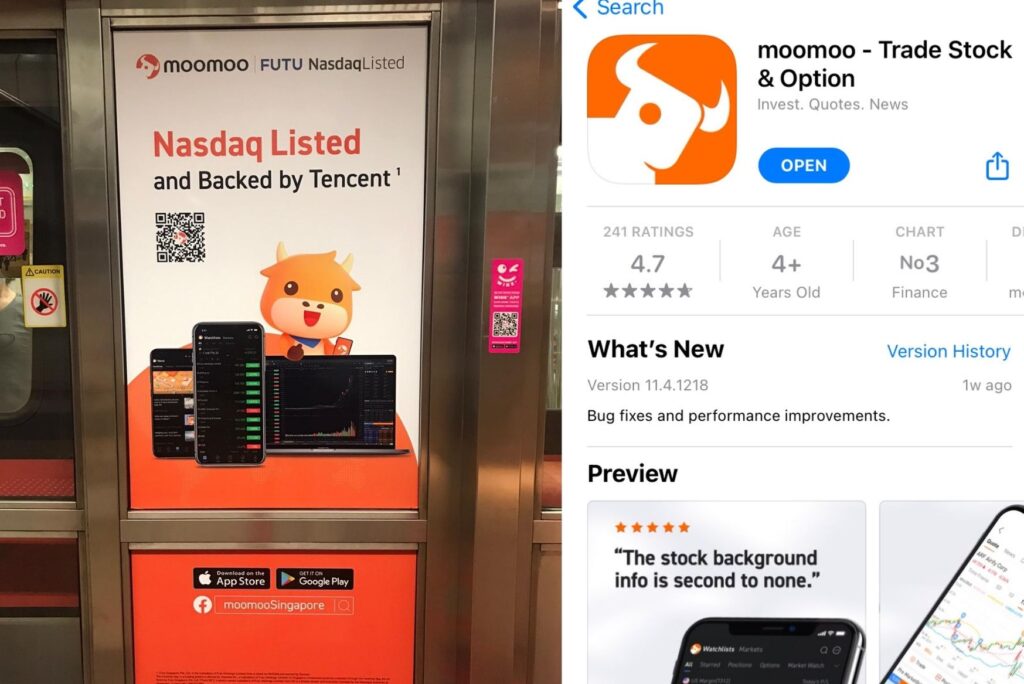

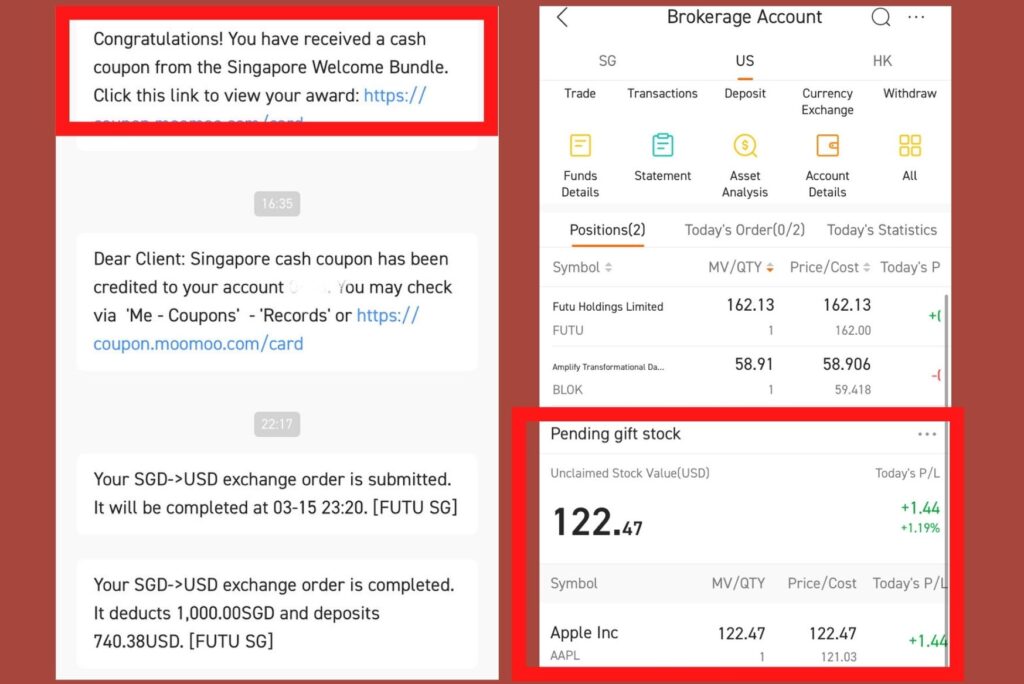

I downloaded the app about a week ago and signed up straight away after knowing that there is an ongoing attractive promotion for new users. New will be issued along with a $30 cash coupon to trade with, provided that they deposited at least SDG 2,700 or USD 2000 into their Moomoo trading account. I did just that and the money was deposited right into the trading account within minutes. Now, that was fast! With the cash in my account, I can start to buy and sell stocks.

Once I’ve started trading US stocks on Moomoo, I knew this was probably the best decision made this year. This app is so user-friendly and easy to use. It may seem to complicate after a while but once you get used to the user interface, it is actually very easy to navigate around. I’m actually quite keen on doing a video tutorial on how to use the app but I probably have to play around with it for a while more so stay tuned!

Here’s why I enjoy using Moomoo trading app.

I want to make it clear that I am not sponsored by Moomoo and the following opinions are based solely on my own. I’m just a fan of the Moomoo trading app and I do not want you guys to miss this out!

1. The app is quite fun to use.

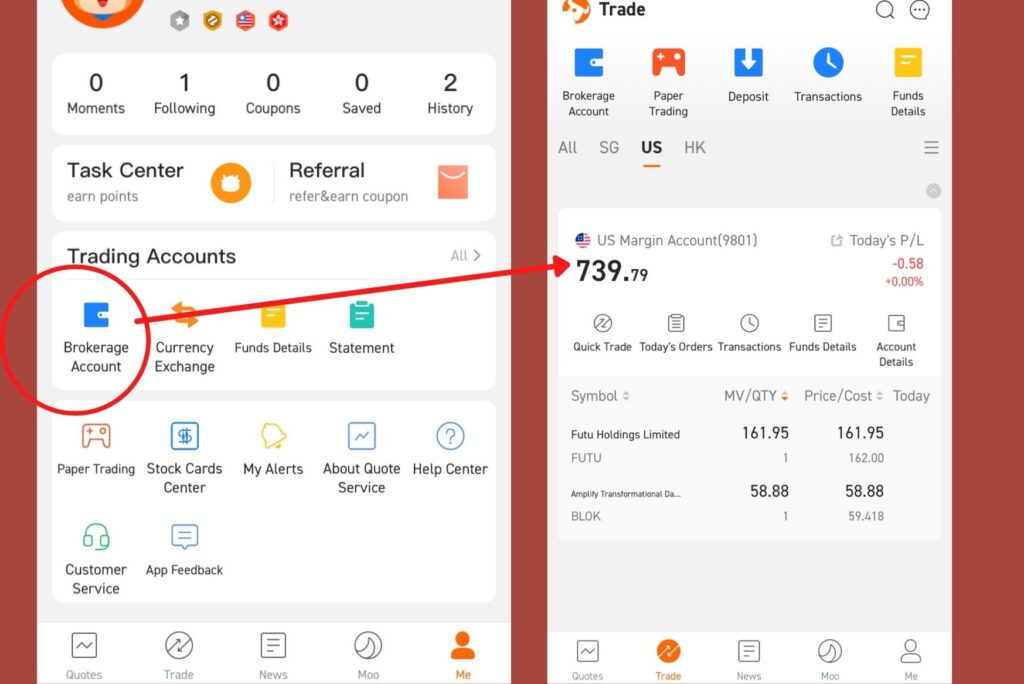

I like their user-friendly interface which is so easy to navigate around. Moreover, Moomoo makes trading fun by including this feature where you can earn points by performing daily tasks like ‘read the news’ and ‘paper trade’. With the points earned, you can exchange them for gifts and rewards. This really makes the app more ‘game-like and motivates the user to keep visiting the app. You don’t find such features offered on other trading platforms like DBS Vickers or TD Ameritrade except for Tiger Brokers which has a similar reward system.

You can earn points daily just by signing in at the ‘Task Center’.

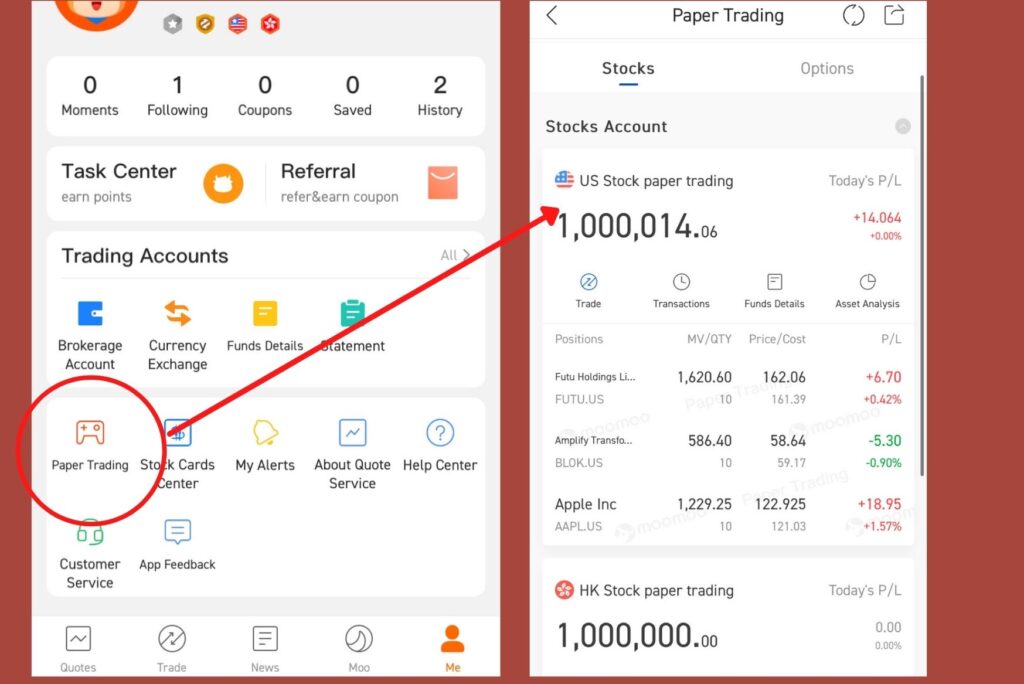

2. You can practise trading until you become a pro to officially trade.

Some trading platforms provide this paper trading feature where you can trade using fake money. If you are new to trading, you can always do paper trading first to understand the market before diving in. It’s like playing Monopoly money.

3. Attractive Perks: 1 Free Apple share + $30 Cash

Receiving a free share is more valuable than cash because the share is an asset that will grow in value over time. Owning 1 free Apple share which is currently worth about USD120++ sounds to me like a really good deal. And does Moomoo really give out 1 free Apple share? Yes, they do and I’m currently holding to 1 Apple share unit after depositing SGD 2700 into my account. In addition, they also deposited $30 into my trading account after I made the deposit. There are also zero commission fees for the next 90 days upon signing up. But do note that they are platform fees which include 7% GST. For pricing matters, you can check out their webpage here.

Unfortunately, all 10,000 Apple shares have been redeemed. But according to Moomoo on their Facebook page, they will be giving out free Apple shares again provided that you deposit money and trade via their platform. Do check out their Facebook page for more information. (Do note that the Moomoo’s promotion has changed as of 27 March 2021. Currently, they are giving out after you’ve executed at least 3 trades.)

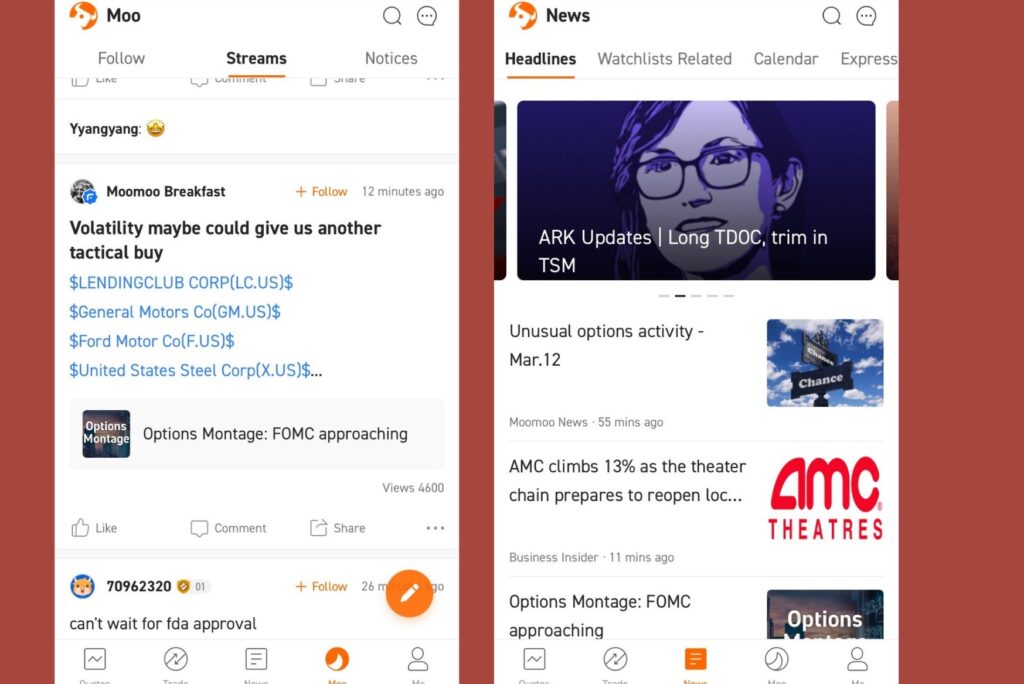

4. It’s interactive, informative and engaging.

You can read the headlines or news on the stock exchange market and also be part of the Moomoo Global Investment community where you can discuss your trading insights with the other 13 million users (according to Moomoo ) from all over the world.

5. Low platform fees

Its platform fees is quite comparable to Tiger Brokers. The fees are US 0.005 per share with a minimum of $1 per order. Thus, if you purchase 100 shares (100 shares x US 0.005 = US 0.5), the platform fees will still work out to be $1 since they will charge you a minimum of $1 per order.

In addition to that, the platform fees are subjected to 7% GST. So if you purchase 200 shares and below, you will be charged $1.07. I would say that their fees are quite comparable to Tiger Brokers.

Nonetheless, Moomoo isn’t the cheapest trading platform. TD Ameritrade has zero platform fees when you trade stocks or ETFs.

Things to take note of when you use Moomoo to trade

Before you start trading on the Moomoo, do take note of the following:

The Stocks You Bought via Moomoo do not get deposited into your CDP account.

- Moomoo only provides custodian accounts for investors to trade. So if you purchase stocks from SGX via Moomoo, the stocks is bought under a custodian account so the stocks do not get credited to your CDP account. That explains why trading platforms like Moomoo can charge lower commission and platform fees.

- In contrast, if you purchase SGX stocks using a CDP-linked brokerage account, the stock will be purchased under your name and they will credited to your own CDP account. When stocks are purchased under your name, it technically means that you are shares of the company and you are considered a shareholder of the company.

- Moomoo will start charging investors commission fees after the promotion period or when your promo is over. You may refer to Moomoo’s commission pricing here.

Investments in stocks bought via Moomoo are subject to risks

- All investments involves some degree of risks. Thus, investors should exercise caution when investing. Avoid trading in a margin account (where the broker loans you cash to purchase stocks) because you may end up losing more than your original amount invested.

- As such, it is important to invest in amounts which you can afford to lose.

Happy trading!

To find out more on how you can trade on Moomoo, watch the tutorial video below.