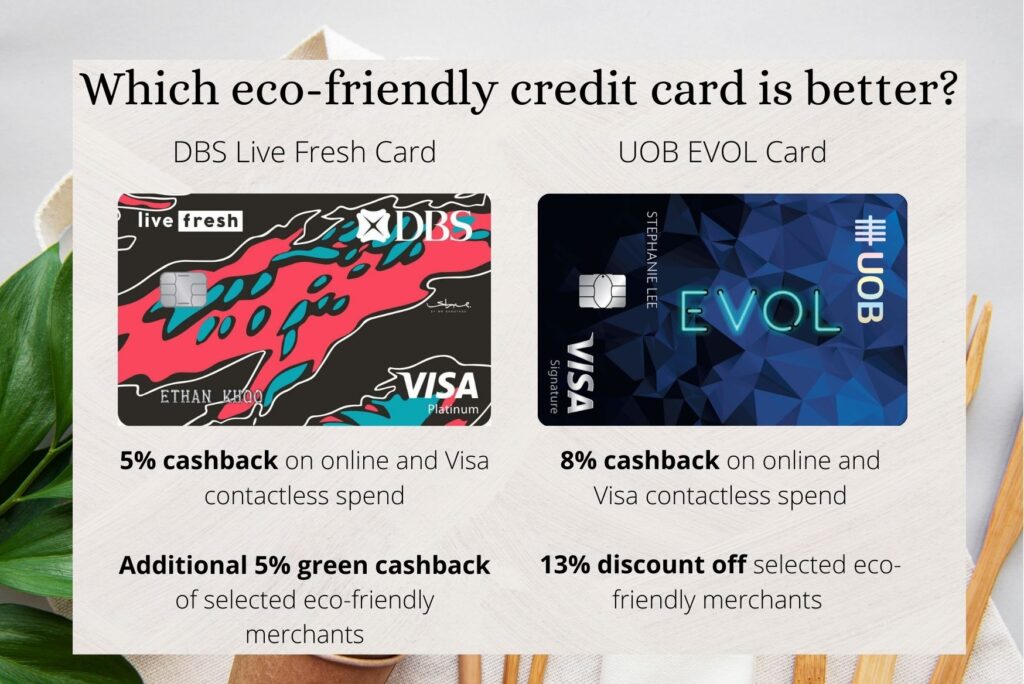

If you’re an eco-conscious or a minimalist individual, there are now credit cards catered just for you. Currently, there are only 2 such eco-friendly credit cards in Singapore that reward you when you shop sustainably and make conscious choices every day with your purchasing power.

Personally, I have been using the DBS Live Fresh Card and just discovered that they have an additional 5% green cashback if you spend at their eco-friendly merchants. The other green card is the UOB EVOL Credit card which has similar benefits to DBS Live Fresh Card. For more details, read on.

DBS Live Fresh Card Credit Card

This DBS Live Fresh card is Singapore’s first eco-friendly credit card which was launched in April this year. The credit card itself is made out of 85.5% recycled PVC (polyvinyl chloride). Each eco-friendly recycled PVC Live Fresh credit card represents approximately 7 grams of carbon reduction and 3.18 grams of waste reduction.

This card rewards you for supporting green and sustainable businesses. So if you are a purpose-driven individual who cares for the environment, this card is for you.

Some of the sustainable businesses include restaurants like Open Farm Community, grocery stores like Scoop Wholefoods, social enterprises like Bettr Barista and eco-transport services like BlueSG. Even taking a bus or an MRT ride via SimplyGo can also help you earn the extra 5% green cashback.

If you are interested in signing up for this credit card, do take advantage of the ongoing promotion where you can earn $300 cashback.

Card benefits

- 5% cashback on online and Visa contactless spend, including SimplyGo rides

- Min. monthly spending of S$600 required to earn bonus cashback

- 0.3% cashback for all other spend, even if you do not meet the minimum spend of S$600

- Earn additional 5% Green Cashback on selected Eco-Eateries, Retailers and Transport Services

- Exclusive discounts and deals across fashion, dining, travel, and entertainment

- Spending on the card and crediting your salary can earn you 1.6% p.a. or more on your DBS Multiplier account

- Cashback is capped at S$20 on eligible online spend, S$20 on eligible Visa contactless spend and S$20 on all other spend per calendar month, totalling S$60

Here’s the catch. The cashback is valid with a minimum spend of S$600 for each calendar month. Cashback is capped at S$15 on eligible Sustainable Spend, S$20 on eligible Online Spend, S$20 on eligible Visa Contactless Spend and S$20 on All Other Spend for each calendar month.

DBS Promotion

- Get S$300 cashback when you apply for a DBS/POSB Credit Card with promo code ‘OCTFLASH‘ and make a min of S$300 spend within 30 days of card approval.

- Applicable to new DBS/POSB Credit Cardmembers only

- Promo period: 5 – 18 Oct 2021

- Terms and conditions apply

You can sign up using this link here.

UOB EVOL Credit Card

Rather than using recycled material, they use bio-sourced material to make the credit cards. The UOB EVOL credit card is made up of 82% plant-based Polylactic Acid (PLA) card material made of non-edible corns. This helps to reduce the use of petroleum-based plastics such as PVC and PET. Each UOB EVOL card saves 4.48 grams of PVC and produces 10 grams less carbon footprint.

Card benefits

- 8% cashback on mobile contactless spend via Apple Pay, Google Pay, Samsung Pay or Fitbit Pay.

- 8% cashback on online spending and 0.3% cashback on other spend.

- No annual fee (just make 3 purchases per month for 12 monthsm before your next annual fee date.

- Enjoy 13% off their list of eco-friendly merchants like barePack, Huggs Coffee, L’Occitane and Salad Stop! when you checkout using their promo code EVOL13

Cashback is capped at S$20 on Online Spend, S$20 on Mobile Contactless Spend, and S$20 on all other spend for each statement month. You need to spend a minimum of S$600 per statement month in order to be eligible for the cashback.

UOB Promotion

Grab the latest Smartphone with S$1,299 Singtel vouchers, or S$300 cash credit when you apply for the UOB EVOL Card by 7 October 2021. Terms and conditions apply.

Which is better? DBS Live card or UOB EVOL?

UOB Evol may sound like a better deal with 8% cashback but both cards have the same cashback limits for online spend, contactless spend and other spend. The only main difference is that DBS Live Fresh card has an extra 5% green cashback while UOB EVOL doesn’t have. However, UOB offers a 13% discount when you shop at their list of selected eco-friendly merchants.

In my opinion, both credit cards are on par with each other. If you already have a DBS multiplier account, I would recommend that you get the DBS Live Fresh card. It will help you to enjoy a higher interest rate.

If you are using UOB, then go with UOB Evol. You also can enjoy a higher interest rate with UOB One account which is similar to DBS multiplier account too. Both are on par with each other.